Pop quiz: What’s the most expensive ingredient in beer?

It’s not barley or hops. Rather, it’s taxes; or so says The Beer Institute, which represents the $252.6 billion beer industry. (Hmm, we can’t imagine what taxes taste like, but imagine they’re more bitter than the hoppiest of IPAs). Anyhow, the institute says taxes cost more than labor and raw materials combined. According to its analysis, the sum of taxes placed on the production, distribution and retailing of beer exceeds 40 percent of the retail price.

But how beer is taxed widely varies throughout the United States. The methods in which its taxed differs, too. For example, some imposed fixed “per-volume” taxes, whiles others enact wholesale taxes, according to the Tax Foundation, a think tank that researches sales and federal taxes. Some states tax distributors and others have a special retail tax on alcohol above and beyond the general sales tax.

The Tax Foundation took a deep dive into beer taxes throughout the country, breaking down states taxes to how they shake out in dollars per gallon.

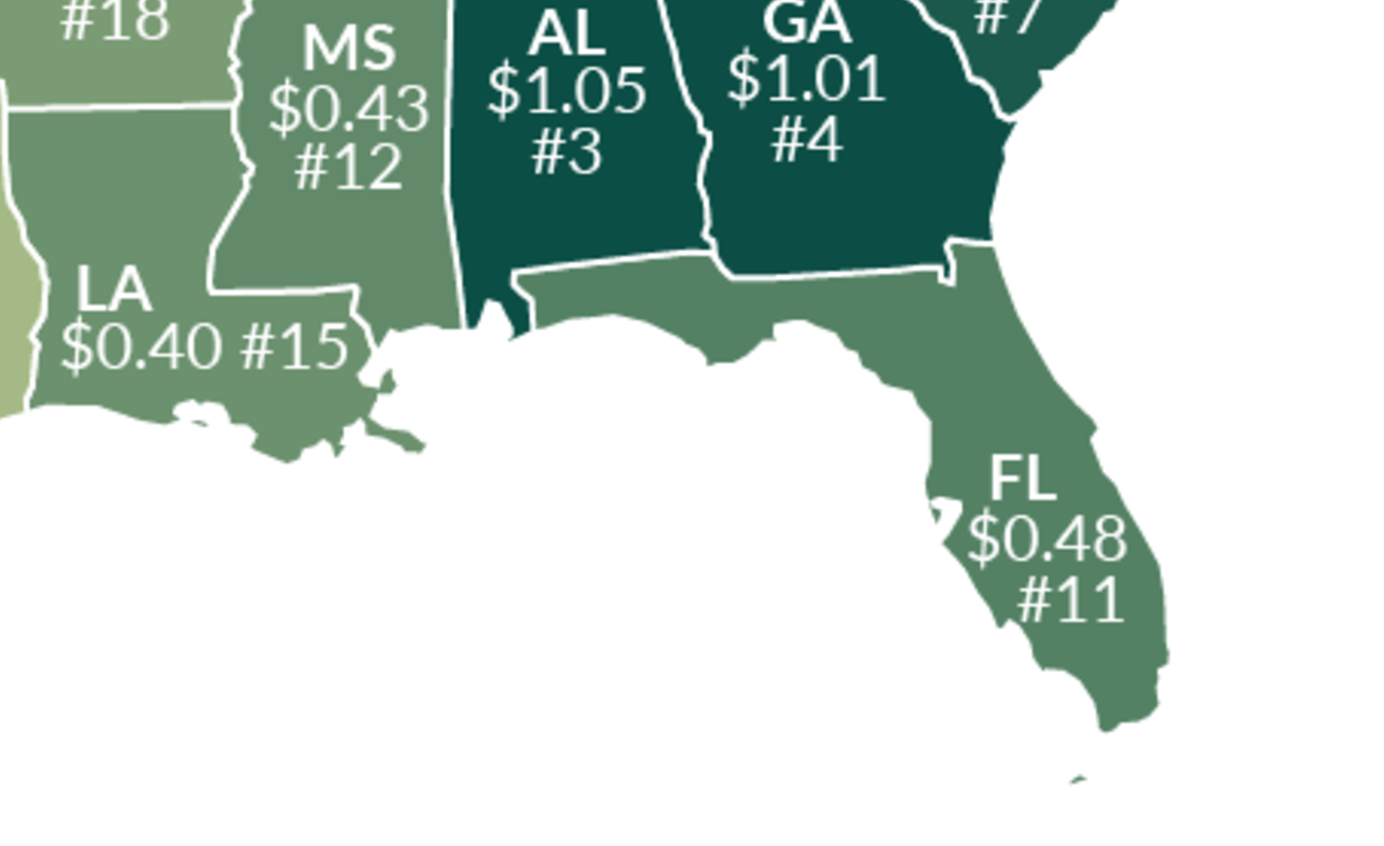

Money points out some trends in the data. For example, beer taxes in the Rocky Mountain region, where there’s a libertarian bend, tends to be low. But Southeastern states, where there’s a strong tradition of Baptist Christianity which discourages drinking alcohol, have among the highest taxes on beer. It seems the beer money could be helping to backfill tax revenue, as Southeastern states tend to have low income and property taxes.

Here’s how beer taxes vary, state by state. The taxes range from 2 cents in Wyoming to, gulp, $1.29 in Tennessee. (We know, that’s tough to swallow!)

Alabama: No. 3, $1.05

Alaska: No. 2, $1.07

Arizona: No. 35, 16 cents

Arkansas: No. 18, 35 cents

California: No. 28, 20 cents

Colorado: No. 45, 8 cents

Connecticut: No. 26, 23 cents

District of Columbia: No. 6, 68 cents

Delaware: No. 35, 16 cents

Florida: No. 11, 48 cents

Georgia: No. 4, $1.01

Hawaii: No. 5, 93 cents

Idaho: No. 38, 15 cents

Illinois: No. 26, 23 cents

Indiana: No. 41, 12 cents

Iowa: No. 31, 19 cents

Kansas: No. 32, 18 cents

Kentucky: No. 6, 83 cents

Louisiana: No. 15, 40 cents

Maine: No. 18, 35 cents

Maryland: No. 9, 52 cents

Massachusetts: No. 44, 11 cents

Michigan: No. 28, 20 cents

Minnesota: No. 10, 49 cents

Mississippi: No. 12, 43 cents

Missouri: No. 48, 6 cents

Montana: No. 39, 14 cents

Nebraska: No. 20, 31 cents

Nevada: No. 35, 16 cents

New Hampshire: No. 21, 30 cents

New Jersey: No. 41, 12 cents

New Mexico: No. 13, 41 cents

New York: No. 39, 14 cents

North Carolina: No. 8, 62 cents

North Dakota: No. 17, 39 cents

Ohio: No. 32, 18 cents

Oklahoma: No. 15, 40 cents

Oregon: No. 45, 8 cents

Pennsylvania: No. 45, 8 cents

Rhode Island: No. 41, 12 cents

South Carolina: No. 7, 77 cents

South Dakota: No. 22, 27 cents

Tennessee: No. 1, $1.29

Texas: No. 28, 20 cents

Utah: No. 13, 41 cents

Virginia: No. 24, 26 cents

Vermont: No. 22, 27 cents

Washington: No. 24, 26 cents

West Virginia: No. 32, 18 cents

Wisconsin: No. 48, 6 cents

Wyoming: No. 50, 2 cents